March 10th, 2023 will likely go down as a seminal moment in the history of the technological ecosystem. Unless you live under a rock, you woke up to the troubling news that Silicon Valley Bank had been closed by regulators, and that the FDIC had taken control. Regardless of what happens next, this marks the end of an era in the valley.

For those of us who have been participants in the technology landscape for any meaningful amount of time, this is a debilitating blow, whether or not you had direct banking exposure to Silicon Valley Bank (SVB) or not. SVB has long been a supporter of founders, fund managers, and limited partners for nearly 40 years, especially those on the emerging and underrepresented front(s). I personally know of many instances where SVB stepped into help various members of these groups, especially when other banks would not. We as a community undoubtedly owe a lot to the services that SVB was able to provide, as they pushed the institution of early stage technology forward meaningfully throughout the years.

Overview

Here is a TL;DR high-level overview for anyone wondering how we got here today:

Due to the abundance of “free money” as a result of zero-interest rate policies (ZIRP) SVB ended up with ~$200B in customer deposits at the end of 2021.

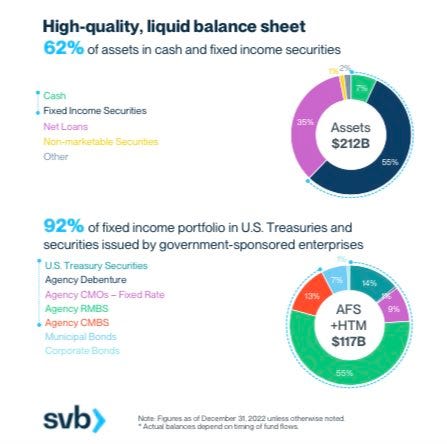

In order to earn some yield on these deposits, SVB invested ~$21B in government treasuries and mortgage backed securities with a 10-year duration and a weighted average yield of 1.79%.

Due to broad inflation across the United States, the Federal Reserve aggressively raised interest rates (10-year sitting at 3.98% as of 3/9/23) causing the notional value of the bond portfolio to drop drastically.

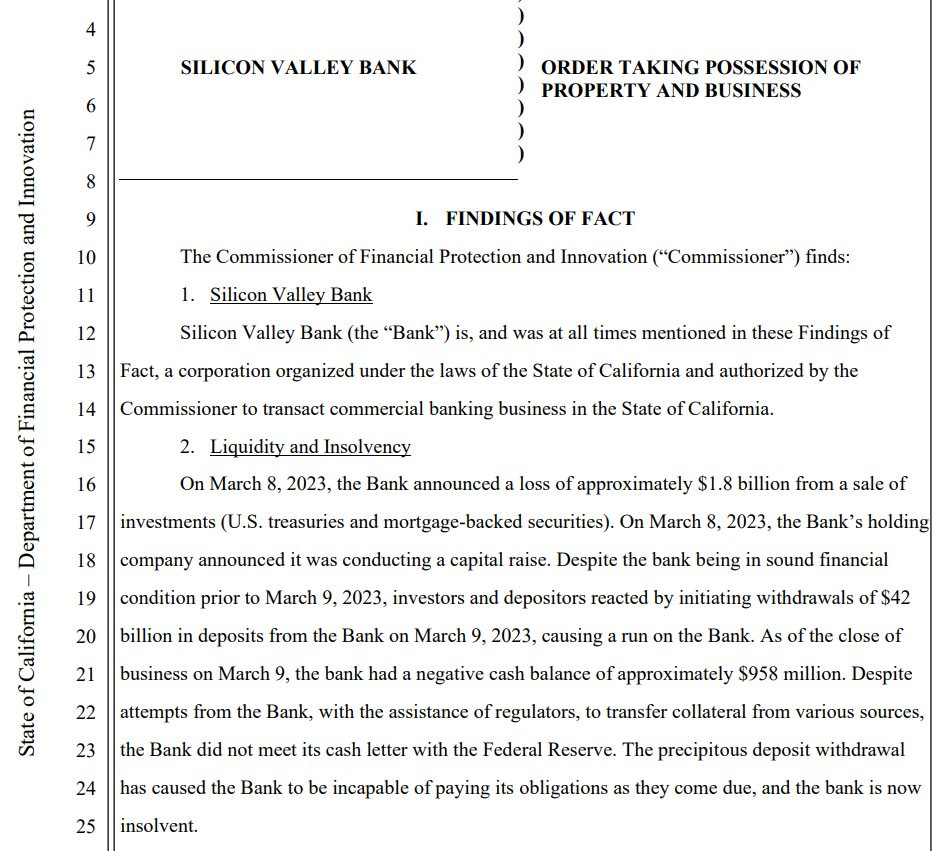

As a result of this rapid rise in rates, Silicon Valley bank was forced to sell this bond portfolio at a ~$1.8 billion loss.

To shore up liquidity on their balance sheet, Silicon Valley Bank planned to offer a $2.3 billion share sale.

This announcement caused Silicon Valley Bank stock to drop ~53% at open, and remain depressed for the entire day.

Due to the uncertainty of both the stock price and available liquidity, the Silicon Valley crowd on Twitter was worked up into a frenzy, causing a run on the bank for both startups and funds alike — with $42 billion in outflows all within a <12 hour period.

By Friday morning, the FDIC had announced that it had taken control of SVB and all of its assets, and were looking to begin an auction process to find a landing.

Fallout

There have been many aspects of the early-stage ecosystem that have been effected by the sudden closure of SVB. Here are a few notable examples:

Payroll providers that relied on SVB payment rails started to see issues:

There were long lines outside of many Silicon Valley Bank physical branches. This is the branch in Menlo Park:

A few cryptocurrency protocols, including the Circle stablecoin (USDC) had reserves at the bank:

4. Outside of technology businesses, other businesses in the Bay Area were also affected:

BlockFi (currently undergoing bankruptcy proceedings) had a large majority of remaining assets in SVB:

Resources:

Below, find some resources to help both founders and funds with exposure to SVB on options to move forward. If you have other meaningful resources you think are worthwhile sharing, please send to @prayingforexits on IG, or gp@prayingforexits.com, so I can edit this post and add them here.

Emergency Credit Line for SVB Customers via Brex.

Our friends at Brex are currently offering an emergency credit line for customers at SVB that are migrating to a Brex Business account here.

Overview on how to claim FDIC Insurance (via Vol1 Ventures)

Full Twitter Thread on this here.

FDIC Insurance Explained

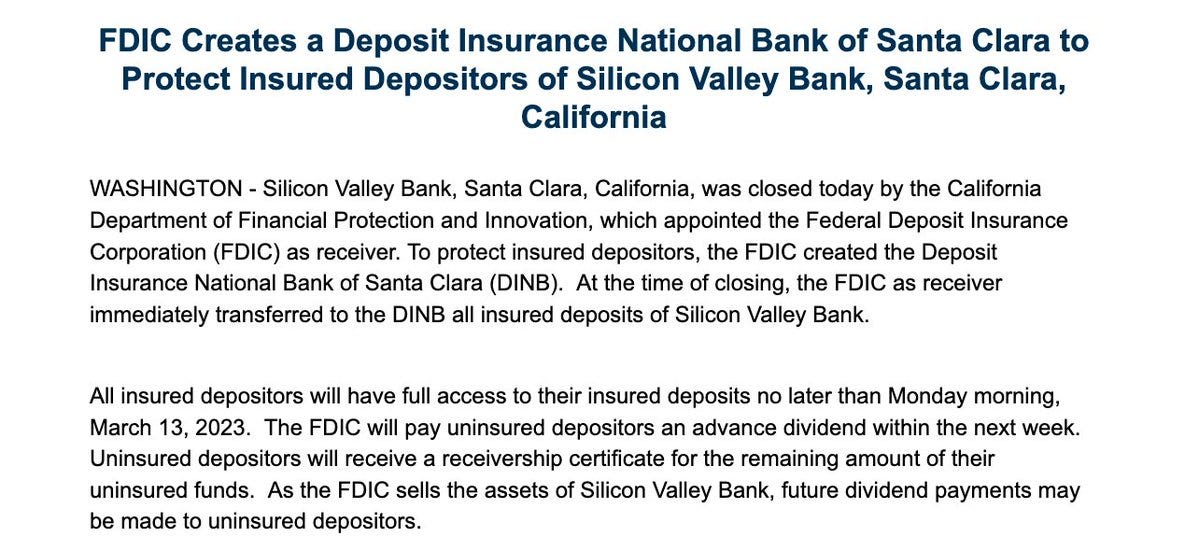

FDIC Insurance was created after the Great Depression during the New Deal to protect consumers from losses at a bank. FDIC Insurance protects up to $250,000 in deposits.

What should you do right now to protect funds?

If you had under $250,000 in funds held at SVB these funds should be available by Monday (March 13th) for removal to another corporate bank account. Please consult counsel before removing any funds to a personal account. You should urgently be looking for another corporate banking account—most likely multiple, not just 1.

In order to have access to the $250,000 in insurance, you must file a claim with the FDIC.

Access the link here.

FDIC: Deposit Claims & Asset Sales

We recommend filing claims by Monday (March 13th) at the latest. It’s to our knowledge that if you file by Monday you should have access to that $250,000 by end of business on Monday (but, of course, this is highly subject to change.)

If you had more than $250,000 held in SVB please call the FDIC at 1-866-799-0959 as well to let them know of your claims.

What materials do you need for filing?

SSN/TAX ID NO. The Claimant's tax identification number (if a company) or his/her Social Security Number (if an individual).

NAME OF PERSON COMPLETING THE PROOF OF CLAIM. Self-explanatory.

NAME OF THE CLAIMANT. This is the person or entity actually making the claim. This may be you or another person or entity on whose behalf you are authorized to file the claim.

AMOUNT OF CLAIM. The dollar amount of the claim.

DESCRIPTION OF CLAIM. Detailed description of what is being claimed (e.g., the invoice number, type of service being claimed, account number, etc.). Additional information may be attached.

NAME. The name of person completing the POC.

TITLE. Include your title if you are filing this POC on behalf of the Claimant.

SIGNATURE. The signature of the person completing the POC.

DATE. Date the form is signed.

FIRM. If you are filing this POC on behalf of the Claimant, include the name of your company or firm, if applicable.

ADDRESS. The address (including City, State, and ZIP code) of the individual completing this POC.

TELEPHONE. Telephone number of the individual completing this POC.

If you have over $250,000 placed in accounts also call the FDIC at 1-866-799-0959. You will still to file a claim.

Overview on how to reach out to your local congressman about what is happening (via Garry Tan)

In an effort to make the receivership process as short as possible, a short note to your local constituent can be helpful in moving the ball forward with providing customers with incremental liquidity. You can reach out here.

Conclusion:

This is a very unfortunate day within our ecosystem — one that could have largely been quelled by both government intervention at an earlier point, as well as a hard look at the social media echo chamber that exacerbated this issue to an untenable degree.

Although nothing has been solidified yet, through the grapevine I’ve heard multiple accounts of both the government and private enterprise figuring out a way to prevent this situation from becoming any worse. As SVB actually had quite a meaningful balance sheet when this all went down, there are multiple options by which there is a “soft landing” for this situation, one in which depositors past the FDIC insurable limit will be made whole (or largely whole) on their balances. It is in the best interest of not only technology, but the financial ecosystem as a whole for this to be figured out with a positive outcome, and I for one have a large amount of confidence that it will.

While it is undoubtedly difficult in these moments, it behooves everyone to remain calm, collected, and thoughtful, as decisions made now will likely have some of the most lasting impacts on how we as individuals, companies, and an industry are able to move forward.

Wishing all the best to those who are going through an especially tough time today. You will come through this stronger on the other end.

- EXITS

For point #2, they had $91B in HTM (Held-to-Maturity) MBS and government securities. This was the bulk of the money held for 10y at 1.7%.

Page 64

https://s201.q4cdn.com/589201576/files/doc_financials/2022/q4/f36fc4d7-9459-41d7-9e3d-2c468971b386.pdf

Thanks for the quick turn around! Easy and informative read.

BTW, the Alchemist Accelerator is maintaining a live doc "Guide to SVB receivership" with the latest news. Please share the below with any startups that are having problems with SVB.

https://docs.google.com/document/d/1DcUMxgE-Tc2k_dPyzNvApbmsf0g2G8UPxhwfHLIWGGY/edit#heading=h.4fv8i0x9bs6g